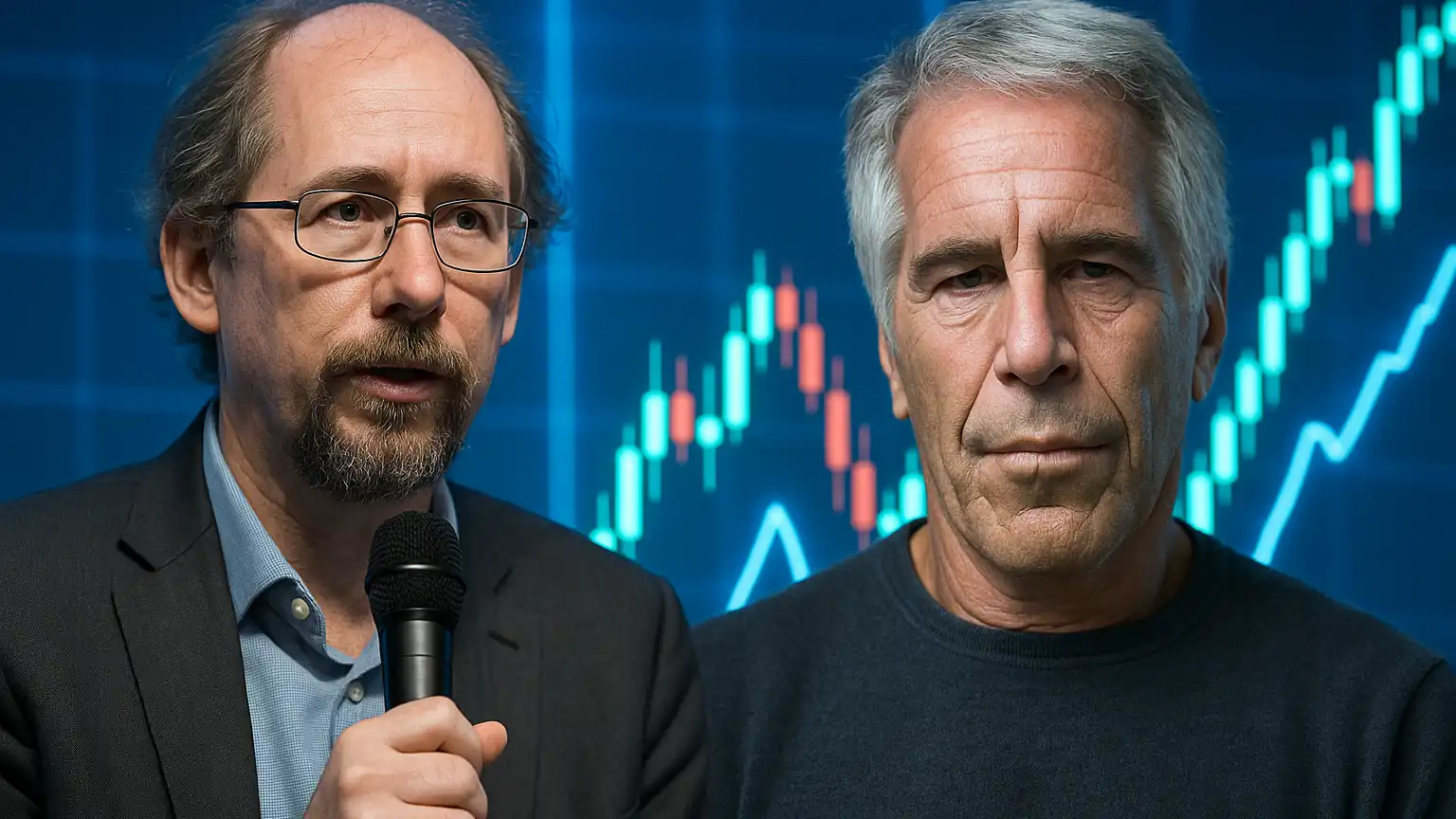

Blockstream’s Adam Back Addresses Epstein Controversy Amid New DOJ File Releases

Blockstream and Epstein: Debunking the Connection

Amid the recent release of documents related to Jeffrey Epstein by the US Department of Justice, the blockchain technology firm Blockstream and its CEO, Adam Back, have come under scrutiny. This attention stems from the revelation of communications during Blockstream’s early days, when the company was in the process of securing seed funding. Back has publicly clarified that Blockstream does not and has never had a financial relationship with Epstein. The link was merely a byproduct of introductions made by Joi Ito, the former director of the MIT Media Lab, who aggregated a group of investors in which Epstein was a limited partner. The fund’s involvement was short-lived, and it severed ties soon after citing potential conflicts.

Unpacking the Historical Context

To better understand the significance of these disclosures, it is crucial to examine the historical context under which these interactions occurred. Blockstream, at the time a nascent blockchain project, was keen on attracting investment to fuel its innovative visions for cryptocurrency development. During 2014, the burgeoning cryptocurrency space was viewed with optimism yet skepticism, a duality that made fundraising a strategic priority for blockchain startups. Within this milieu, Ito’s investment fund played a pivotal role by introducing notable figures, including Epstein. The fund held a minority stake for a brief period before disentangling itself due to the emerging ethical considerations that surfaced about Epstein’s background.

The Trails of Epstein’s Financial Ties

The widened scope of the DOJ’s release has drawn Blockstream unintentionally into the focus. However, none of the documents suggest that Blockstream’s business operations were influenced or funded by Epstein. The DOJ has cautioned that mere inclusion of individuals in the documents is not an indictment of wrongdoing. As files continue to surface, the crypto industry at large must reckon with the ethical implications of past associations, highlighting the necessity for transparency and due diligence in partnership engagements.

The Impact of Speculation and Scrutiny

The scrutiny faced by Blockstream highlights a broader theme within the cryptocurrency community—how reputational risks are managed and how past affiliations are revisited by both media and industry insiders. In an era where information can be rapidly disseminated and scrutinized, businesses must proactively address concerns to maintain public trust. For public companies dealing with cutting-edge technologies like blockchain and cryptocurrency, even tangential associations with controversial figures can impact market perception.

Epstein’s Cryptocurrency Interest: Delve into Elite Networks

The DOJ’s released files not only reignited discourse on Blockstream but also opened discussions on Epstein’s investments and interests in cryptocurrency. Prior to his arrest, Epstein had shown keen interest in Bitcoin and had held discussions with various tech and finance personalities about the burgeoning digital currency landscape. Epstein’s engagements with digital currency ideas, though not publicly documented until now, reflect his attempt to align himself with avant-garde financial innovations potentially to expand his influence networks.

Global Figures in the Web of Influence

Another revelation from the DOJ documents pertains to Epstein’s interactions with a spectrum of elite figures from the finance, technology, and political realms. Notably, these records included mentions of industry leaders and innovators who seemed to have been on Epstein’s network list. Such insights conjure a complex tapestry of interconnections which has now become subject to public scrutiny. This has prompted renewed dialogues about ethical conduct and prudence in forming professional alliances, especially when individuals of disrepute are involved.

The Complexities of Reputation in the Crypto World

The unveiling of these documents underscores a critical narrative—the delicate balance between innovation and reputation within the cryptocurrency ecosystem. In a field that thrives on disruption and futuristic thinking, the cost of potential reputational damage can be substantial, affecting not only financial outcomes but also the ethical landscape. Companies within this sphere are being called upon to reassess their policies on partnerships and formalize robust frameworks to mitigate reputational risks.

Conclusion: Navigating a Contentious Era

As more materials emerge from the DOJ’s investigation into Epstein, firms within the cryptocurrency sector are taking stock of past dealings and reevaluating the integrity of their networks. Blockstream’s case exemplifies the intricacies involved when past associations resurface. It is a potent reminder of the ethical parameters businesses must navigate. The ongoing discussion about transparency, accountability, and ethical funding remains central to the evolution of the cryptocurrency industry. Navigating these challenges requires diligence, foresight, and a commitment to aligning innovation with ethical stewardship.